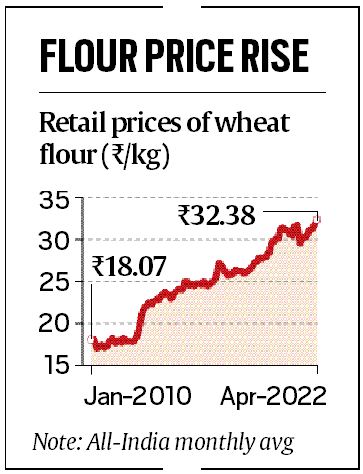

The all-India monthly average retail price of wheat flour (atta) was Rs 32.38 per kg in April, the highest since January 2010, the earliest month for which data are available.

Atta prices have been rising as both production and stocks of wheat have fallen in India, and demand has risen outside the country.

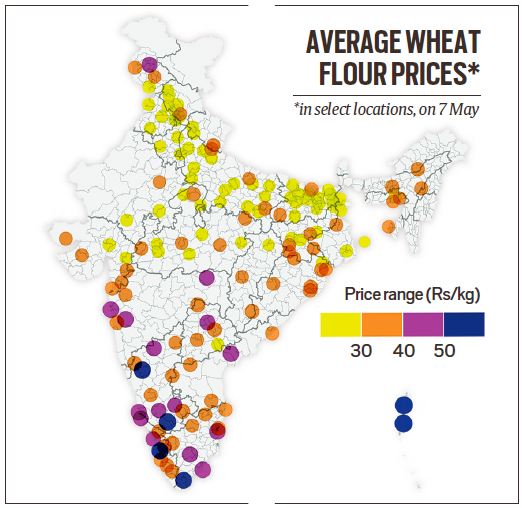

Data reported by State Civil Supplies Departments to the Union Ministry of Consumer Affairs, Food and Public Distribution show the all-India average retail price of wheat flour was Rs 32.78/ kg on Saturday (May 7) — 9.15 per cent higher than the price (Rs 30.03 per kg) a year ago.

Among the 156 centres for which data are available, the price on Saturday was the highest in Port Blair (Rs 59/ kg) and lowest (Rs 22/ kg) in West Bengal’s Purulia.

Among the four metros, the average wheat flour retail price was the highest in Mumbai (Rs 49/ per), followed by Chennai (Rs 34/ kg), Kolkata (Rs 29/ kg) and Delhi (Rs 27/ kg).

All-India average daily retail prices of wheat flour have been rising since the beginning of the calendar year, having increased by 5.81 per cent since January 1, the data show. The record high in April was significantly higher than the average retail price of Rs 31/ kg recorded in April 2021.

Sources said that the steady increase in the price of flour is due to the rise in wheat prices amid the fall in production due to the war in Ukraine, and a higher overseas demand for Indian wheat. The high domestic price of diesel has added to the logistics cost of both wheat and flour.

The retail inflation, based on the Consumer Price Index, of non-PDS ‘wheat/atta’ reached 7.77 per cent in March 2022, the highest since March 2017, when it was recorded at 7.62 per cent.

Along with wheat flour, the prices of bakery bread too have registered a sharp increase in recent months. Retail inflation for bakery bread was 8.39 per cent in March this year, the highest from January 2015 onward, the period for which comparable data are available.

The prices of flour and bread are rising at a time when the country is staring at a fall in wheat output. The government had set a wheat production target of 110 million tonnes for 2021-22, which is higher than the estimated production of 109.59 million tonnes in 2020-21. In fact, the second advance estimates released by the Ministry of Agriculture and Farmers Welfare on February 16 this year, pegged the total wheat output for 2021-22 at 111.32 million tonnes.

The sudden increase in temperatures in March, however, dampened the government’s hopes of record production. Officials now say the total wheat production for 2021-22 might fall short of the target. Union Food Secretary Sudhanshu Pandey said last week that wheat production was expected to be around 105 million tonnes. A statement issued by the Food Ministry cited the early onset of summer as a reason for the decline in wheat yield.

The fall in production and higher demand from private buyers has seen wheat prices in the open market hovering above the minimum support price (MSP) of Rs 2,015 per quintal announced by the government for the current rabi marketing season. In this situation, public procurement by government agencies is expected to fall short of the target. As per Food Ministry estimates, wheat procurement during the current rabi marketing season is likely to be 195 lakh tonnes, significantly below than the government’s initial procurement target of 444 lakh tonnes and last year’s actual procurement of 433 lakh tonnes. As per information available on the FCI portal, 156.92 lakh tonnes of wheat had been procured until April 28.

Food Ministry data show wheat stocks stood at 190 lakh tonnes at the beginning of the 2022-23 financial year, which, with the 195 lakh tonne procurement in the current season, is expected to rise to 385 lakh tonnes. Taking into account the allocations for distribution under the National Food Security Act (NFSA), 2013; Other Welfare Schemes; and Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY), 2022-23 is expected to end with a balance of 80 lakh tonnes of wheat in government stocks, a little more than the minimum stocking norm of 75 lakh tonnes as on April 1.

“From the overall grain management side, we are still in a surplus situation…,” Pandey told a press conference last week. “This year due to increased market prices and higher demand by private players both for domestic and export purposes, the purchase by government agencies is less, but that goes in favour of farmers. Farmers are getting good prices for wheat; earlier they were not getting that price, and had no option but to sell to the government,” he said.

Food Ministry officials said contracts have been finalised for the export of 40 lakh tonnes of wheat, and 11 lakh tonnes were exported in April. India exported about 70 lakh tonnes of wheat last year (2021-22).

In view of the lower opening stock and lesser procurement, the government has begun to rework its wheat math by revising the states’ allocations under the PMGKAY, under which 5 kg of foodgrains per month are being provided free to individual beneficiaries covered under the NFSA.

After the revision, wheat allocation under PMGKAY will come down to 7.12 lakh tonnes per month from the 18.21 lakh tonnes per month now, enabling the government to save about 55 lakh tonnes of wheat during the remaining five months of PMGKAY, which is scheduled to run until September.

While the NFSA and PMGKAY have provided a cushion to about 80 crore beneficiaries, a large number of people living just above the line are not covered under any foodgrain scheme of the Centre or states. This group of people are likely to be hit the hardest by the rising prices of atta and bread.