In the wake of Russia’s invasion of Ukraine, energy prices have skyrocketed, leaving many European countries uncertain of their ability to meet demand in the medium to long term. While the potential of Russia cutting off supply is at an all-time high, as of now, the pipes continue to flow. Europe is Russia’s main market for energy exports, and in turn, also its main source of revenues. Acknowledging the mutually dependent relationship, Western sanctions have largely bypassed Russia’s energy sector resulting in a paradox in which Europe seems on the precipice of war with the Kremlin while continuing to trade with it in key commodity markets.

How much does Europe depend on Russia

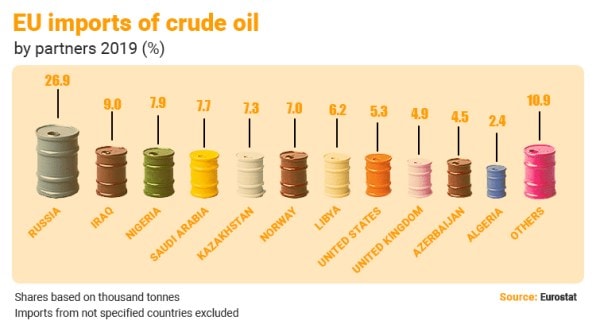

Russia is the world’s second-largest producer of petroleum after the United States although, at times, its position fluctuates with that of Saudi Arabia. Russia produces close to 11 million barrels of crude oil per day, of which roughly half the output is used to meet domestic demand. About half of Russia’s oil output is shipped to European countries and another large chunk goes to China.

Europe has more flexibility in terms of its oil supply relative to that of natural gas. This is because gas requires complex infrastructure to store and transport whereas oil is easier to replace from elsewhere. Many countries and regions produce crudes similar in quality to Russian oil and OPEC typically maintains large reserves of spare capacity. While Russia holds more leverage when it comes to natural gas, it earns far more from oil. In 2021, Russia earned over $110 billion from oil exports, twice as much as its earnings from natural gas sales abroad.

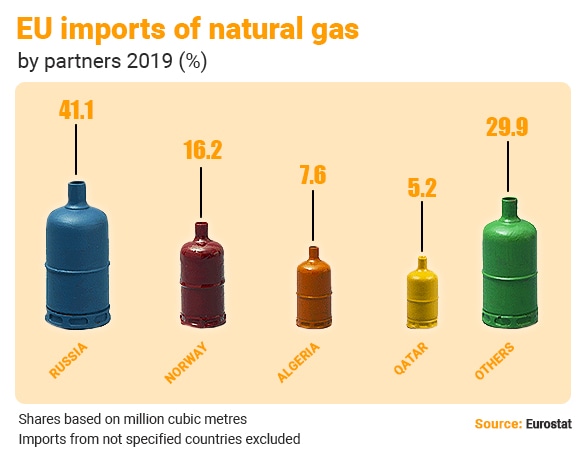

Europe gets around a quarter of its energy from gas. In 2019, Russia provided 41 per cent of that gas. With abundant gas reserves and an extensive existing pipeline network, Russia dominates the EU’s gas markets, with the bloc’s next largest source, Norway, accounting for 16 per cent.

In 2021, energy prices increased due to limited supply and over the last month, have once again risen substantially. The natural gas spot price at the Title Transfer Facility in the Netherlands has been trading at an all-time high and the price of Brent crude, the international benchmark, hit its highest since 2014.

Based on predicted energy prices, the IMF has forecast that growth rates in advanced economies would drop from 4.4 per cent last year, to 3.5 per cent in 2022. Additionally, the global consultancy Capital Economics warns that an increase in prices could raise inflation by an additional 2 per cent, pushing rates in many countries to a dangerously high 10 per cent.

Has Europe become less dependent on Russian oil and gas over time?

Simply put, not really.

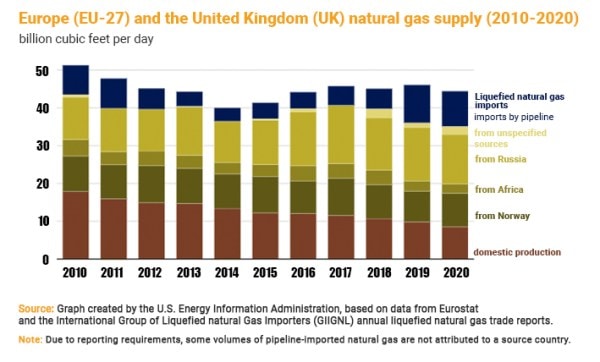

Source: Graph created by the US Energy Information Administration

Source: Graph created by the US Energy Information Administration

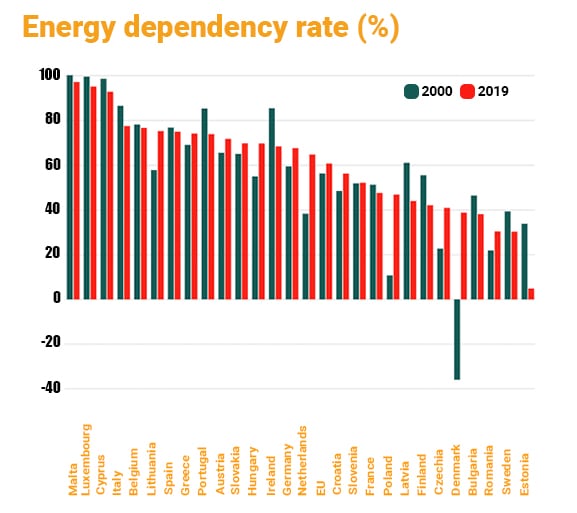

The dependency rate shows the extent to which an economy relies upon imports in order to meet its energy needs. According to the US Energy Information Administration, in the EU in 2019, the dependency rate was equal to 61 per cent, which means that more than half of the bloc’s energy needs were met by net imports (from all sources.) While some countries like Estonia are almost completely insulated from Russian energy, others, like Malta and Luxembourg import most of their energy, a lot of which comes from Moscow. This is particularly true for natural gas.

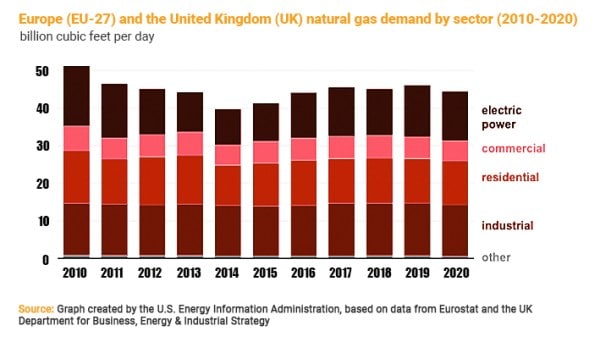

Russian natural gas supply to Europe has remained largely consistent in the last decade while domestic production has dwindled significantly. Barring brief periods, notably during Russia’s annexation of Ukraine in 2014, its supply of natural gas to Europe has remained fairly consistent.

Europe’s natural gas production has been in continuous decline because of production limits in key sites like the Groningen field in the Netherlands along with other initiatives to phase out gas in the region. The decline is also a result of resource depletion and downturns in output in the mature fields of the North Sea. While some of these policies were put in place to encourage greater transition into domestic renewable energy production, it has resulted in an increased dependency on Moscow.

As we see in the graph above, most sectors have failed to diversify away from natural gas, barring the electric power sector which fell between 2010 and 2014 as a result of increasing penetration of renewable energy in electricity generation. However, countries struggle to transition directly from coal to renewables, needing natural gas, a reliable and efficient source of energy to fill the gap. Therefore, as Europe began to retire coal-fired plants in 2016, and in particular, as Germany retired nuclear power plants, consumption of natural gas in Europe’s electric power sector increased.

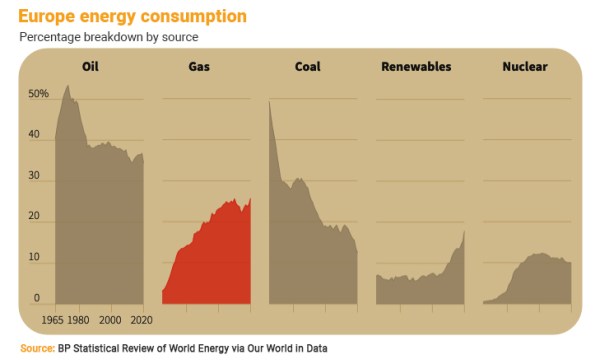

Since 1965, Europe has vastly reduced its consumption of coal and oil but while renewables can account for some of the loss, it’s clear that gas has done the heavy lifting.

How would Russia shutting off gas flows impact Europe?

First off, Ukraine is likely to be hit hardest given its dependence on Moscow both for energy and for income through pipeline fees. Moscow is no stranger to using energy as a geopolitical weapon in its skirmishes with Ukraine. Until the mid-2000s, Ukraine was receiving the same heavily subsidised gas shipments as it did when it was part of the Soviet Union but following the 2004 Orange Revolution that denied the pro-Russian candidate the presidency in Ukraine, Russia’s largest gas producer Gazprom demanded that Ukraine pay full market rates.

Although Russian pipelines almost exclusively passed through Ukraine during the Soviet era, since then, Russia has invested in infrastructure that bypasses Kyiv. Most notably, it constructed the Nord Stream pipeline to deliver Russian gas directly to Germany. Opening in 2011, the pipeline reduced Russia’s reliance on Ukraine, and resulted in the annual loss of transit fees for the latter amounting to $720 million.

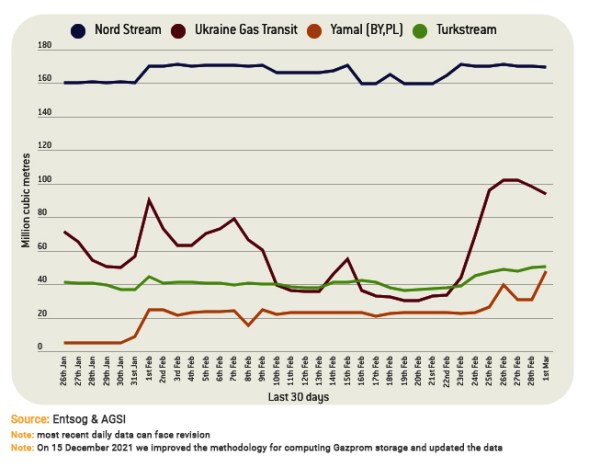

In the last month, Russian gas flowing through Ukraine has been extremely volatile with peaks and lows corresponding with key dates of the conflict. Ukraine earns an annual $1 billion in transit fees from Russian pipelines and was particularly hard hit last year when gas delivered to Europe from Russian pipelines fell by 25 per cent.

The rest of Europe will also be destabilised if Russia were to hamper or cut off supply. In the past, it has fulfilled its contractual obligations even in times of conflict but has ceased providing excess supply that many countries rely on in the cold winter months. This time, with a particularly bullish Putin at the helm, countries are bracing themselves for even worse.

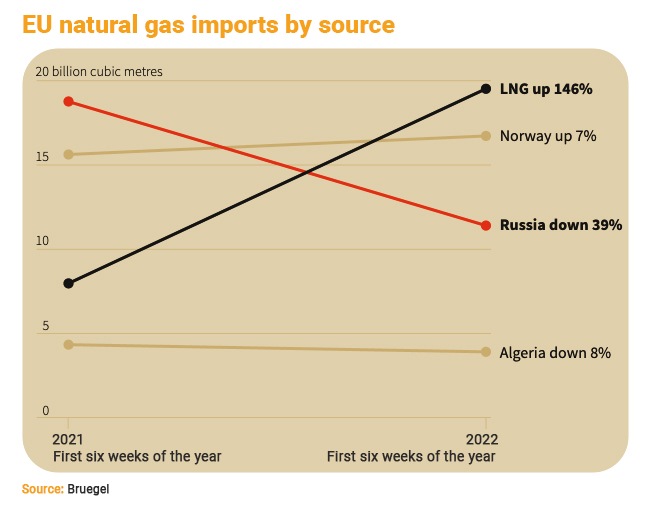

As the conflict escalated in 2021, Europe’s reliance on Russia decreased and its imports of LNG from other sources increased by 146 per cent.

The EU has said that it would be able to cope with a partial cut-off of gas and has spoken with the US, Qatar, Egypt, Azerbaijan and other countries about increasing deliveries of Liquified Natural Gas (LNG.) Already, exports of LNG from the US increased almost twofold between November 2021 and January 2022. However, there are two substantial problems with relying on LNG. First, given its infrastructural requirements, it is far more expensive (up to 40 per cent) than gas flowing through pipelines. This is because LNG must first be turned into a liquid and then de-gassed at terminals, usually near the coast, before it can be used to power homes.

There is also an acute shortage of supply. The biggest exporters of LNG are already exporting at near full capacity and it takes a long time to expand liquefaction and export capacity, so Europe’s best short term hope would be to get hold of existing cargos headed for elsewhere. However, there is high demand for natural gas in Asia as well, with China being the world’s biggest importer.

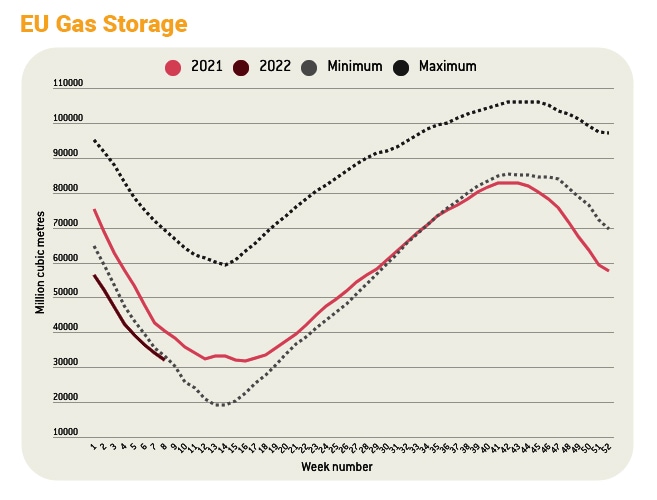

Storage is an additional concern. Last year’s brutal winter along with Gazprom’s reluctance to fill storage units, left gas storage at levels below the five year norm. Analysts debate how much the storage capacity could mitigate a Russian cut-off, with some predicting two months and others, up to four. If the region were forced to consume its gas stocks to survive, it would then have to spend even more during the summer to build up reserves. Already, JP Morgan predicts that without a shut off, Europe will spend $1 trillion on energy this year, up from $500 billion in 2019.

Conversely, cutting of gas supplies to Europe would also affect Russia. A complete cut off would cost Gazprom between $203 million and $228 million a day, resulting in $3 billion in lost revenue over three months. If the embargo continues into the summer months, Putin also loses leverage as demand drops down to 60 per cent that of January. However, Russia has built up all-time high foreign exchange reserves and very low sovereign debt that would help Russia weather this storm.