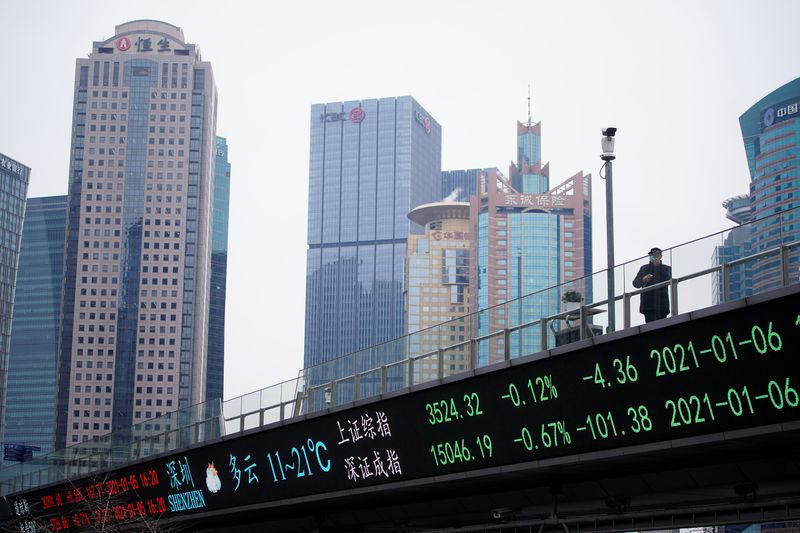

© Reuters. FILE PHOTO: A man wearing a face mask, following the coronavirus disease (COVID-19) outbreak, stands on an overpass with an electronic board showing Shanghai and Shenzhen stock indexes, at the Lujiazui financial district in Shanghai, China January 6, 2021

2/2

By Lawrence Delevingne

BOSTON (Reuters) -U.S. stock indexes were generally weaker on Monday, giving back some of last week’s gains, and oil prices jumped as investors refocused on risk as the conflict in Ukraine continued.

The fell 186.13 points, or 0.54%, to 34,568.8 and the dropped 4.79 points, or 0.03%, to 13,889.04, while the was virtually flat.

Boeing (NYSE:) shares fell by around 4% after one of its 737 jets crashed in China.

Global stocks rallied last week in anticipation of an eventual peace deal on Ukraine, but it will likely take actual progress to justify further gains.

Turkey’s foreign minister said on Sunday that Russia and Ukraine were nearing agreement on “critical” issues and he was hopeful for a ceasefire if the two sides did not backtrack from progress achieved so far.

On Monday, Ukraine defied a Russian ultimatum that its forces lay down arms before dawn in Mariupol, while the European Union was set to consider a possible energy embargo against Russia.

“The coming days will be a litmus test on whether last week’s risk-on rally was overdone. Hopes related to a peaceful resolution in Ukraine have relied on headlines more than evidence,” said ING’s Francesco Pesole and Chris Turner.

The MSCI world equity index was 0.05% higher as of 1540 GMT. European shares were choppy with the pan-regional benchmark up 0.21%.

The war in Ukraine, surging commodity prices, supply chain issues and policy tightening have all made investors less upbeat about the prospects for global earnings growth.

BofA’s global fund manager survey last week had a bearish bias with cash levels the highest since April 2020 and global growth expectations the lowest since the financial crisis of 2008. Long oil and commodities were the most crowded trade, and vulnerable to a pullback.

EYES ON THE FED

Bond investors braced for more hawkish language from the U.S. Federal Reserve with Chair Jerome Powell speaking on Monday and other Fed members through the week.

Policymakers have flagged a string of rate rises ahead to take the funds rate to anywhere from 1.75% to 3.0% by the end of the year. The market implies a 50-50 chance of a half point hike in May and an even greater chance by June.

Atlanta Federal Reserve Bank President Raphael Bostic said on Monday he had pencilled in a total of eight interest rate hikes for this year and the next, fewer than most of his colleagues as he worries about the effects of Russia’s invasion of Ukraine on the U.S. economy.

The yield on benchmark rose to 2.2445%, while the yield on two-year notes increased to 2.03%. It was the first time since May 2019 that the two-year note, which typically moves in step with interest rate expectations, topped 2% – the Fed’s target rate for inflation.

Morgan Stanley (NYSE:) rate strategists are calling for the closely watched 2-year/10-year U.S. Treasury yield curve to invert in the second quarter. “While this doesn’t guarantee a recession, the signal on growth is clearly negative,” they wrote in a note.

The dollar was little changed versus a basket of major currencies, as investors looked toward Fed official comments for insight on monetary policy.

The steadied at 98.21, off its recent peak hit earlier in March at 99.415. The euro was flat at $1.104, after surging 1.3% last week.

In commodity markets, gold has failed to get much of a lift from safe-haven flows or inflation concerns, losing more than 3% last week. It was last up 0.6% on Monday at $1,933.44 an ounce. [GOL/]

Oil prices pushed higher on Monday, after losing ground last week, as there was no easy replacement for Russian barrels in a tight market.

jumped 5% to $113.38, while rose 4.47% to $109.38 a barrel after news the EU was considering joining the United States in a Russian oil embargo, while a weekend attack on Saudi oil facilities caused jitters. [O/R]